Clinical study on inflation incidence in salary vs. business benefits relationship with application in Argentina 2016-2022

Estudio clínico sobre la incidencia de la inflación en la relación salario vs. beneficios empresariales con aplicación en Argentina 2016-2022

José Luis Infante (1)

Abstract

Inflationary processes produce informative modifications when prices are distorted, one of them being the labor wage. Parity-type negotiations where, on the one hand, employers seek to defend the position of benefits while, on the other, workers seek the same with wages, show spaces of asymmetric information that, a priori, are more complex the greater the inflation is. Economic theory has discussed for years the mark up relationship, as the ratio between benefit and price, and the wage share. Intuition leads us to think that the higher the mark up, the lower the participation of wages in costs, making up a trade off. But it is not intuitive how inflation affects the mark up. This paper analyzes this relationship from an economic model that reflects it and applies it to the case in Argentina in the period 2016-2022.

Keywords: Inflation, mark up, negotiation, profits, trade off, wage.

Resumen

Los procesos inflacionarios producen modificaciones informativas al distorsionarse los precios, y uno de ellos es el salario laboral. Las negociaciones del tipo paritarias en las que, por una parte, los empresarios pretenden defender la posición de beneficios mientras que, por la otra, los trabajadores buscan lo propio con los salarios, evidencian espacios de información asimétrica que, a priori, son más complejos cuanto mayor es la inflación. La teoría económica ha discutido por años la relación mark up, como cociente entre beneficio y precio, y la participación salarial. La intuición lleva a pensar que a mayor mark up, menor participación de los salarios en los costos componiendo un trade off. Pero no resulta intuitivo como afecta la inflación al mark up. Este trabajo analiza esa relación desde un modelo económico que lo refleje y aplica al caso en Argentina para los años 2016-2022.

Palabras clave: Beneficios, ganancias, inflación, margen, paritarias, salarios.

Recibido/ received: 04/10/2022 Aceptado/ accepted: 15/02/2023

(1) Profesor de la Universidad Nacional de La Plata (UNLP), calle 6 y 48, La Plata, Buenos Aires, Argentina. Ingeniero hidráulico y Magister en Economía. jose.infante@ing.unlp.edu.ar

Introduction

Wages in corporate income is not constant (Erausquin, 2020). From a microeconomic analysis, wages tend to compete with corporate profits in zero-sum games1 (Palazuelos, 2008). This paper tries to analyze the behavior of an eventual trade off2 between corporate income and wages in the face of rising inflation. The problems derived from this effect is significant both from macroeconomic and microeconomic implications.

The macroeconomic effect implies the understanding of a conflict called distributive bidding (Keyman, 1986), which derives in social tensions. From a microeconomic effect, it implies the construction of tense negotiations between the business and union sides.

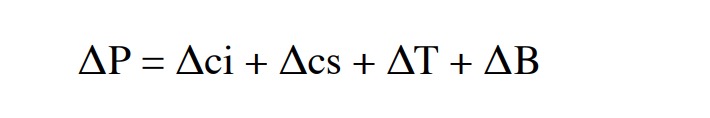

Then, the above-mentioned zerosum game explains the eventual trade off analyzed in this paper. In the microeconomic point, the profit implies endogenous effects and motivations as long as the exogenous is described by supply contracts and parity wage negotiations. In their motivations, accounting problems grow producing inefficiencies in wage agreements. Nominal and real state diverge. This enabled information asymmetries and veils of opacity (Akerloff, 1970) in favor of the most informed, who are usually the employers. We can sense the presence of a trade off between wages and profits that changes according to the inflationary rate. Going deeper into the case, the competitive context is not negligible. Going to the technical prices (offer prices), these can be considered as an aggregate model that integrates reimbursements and contributions. If accepted by a customer in a sale purchase, a producer price would be composed of reimbursements representing the costs in materials, labor, financial and others; a measurable and regulated magnitude corresponding to taxes or, otherwise, the forced contribution for the support of the structures and organizations that validate and give credibility to the economic act; and, finally, the unregulated contribution that focuses on the profit. Of course, every customer who operates this economic act does not see such aggregates, even if he intuits them, but they understand the delivery of a certain amount of money, which is the purchase price or effective demand, against the assignment of a right or delivery of a product. In this logic, assuming an informed consumer, they will have in their memory a level or range of prices that they can pay for the consideration sought. Then, a customer will not pay more than what he or she expects. A price above the upper limit of its range will be considered high or expensive, while below the range it will be considered low or cheap. Every customer will consider a price within its range to be reasonable, this being a very significant signal for that customer to freely accept to purchase the product3 . With this behavior, which in economics is known as rationality (Streb, 1975) (Mas Collel, 1995) and which in other areas of analysis supports the concept of freedom of choice (Romero Huamani, 2014), it is foreseen a management in the companies in order to reach a stable client. If this did not happen, a company in a situation of selling its products would have enough market power (Motta, 2004) to convince a customer to choose the product offered regardless of its characteristics and price. The described anomalous and short-sighted behavior (Kydland and Prescott, 1977), also called abuse of dominant position or monopolistic behavior, hides all kinds of inefficiencies of the companies and a quasi-guarantee in obtaining profits financed by excessive and ruinous price increases. Faced with this hypothetical scenario in the purchase and sale, it could be assumed that there would be no room for negotiation where a company seeking a profit and a union or worker seeking a salary would enter into a conflict zone of the trade off type4 . However, outside this non-stable and short-term behavior, companies must compete to achieve sales with different product offers that materialize some non-ruinous market power5 . In these relationship spaces the trade off under analysis materializes. The mechanics would be the following. Being a decision, a certain application of a given technology and quality level, inputs present high rigidity to change, both in their unit consumption6 , as well as in their B2B price7 . Taxes cannot be modified and are even more rigid than inputs. Therefore, if price is a competitive magnitude, the firm sells at the price it takes from the market. Therefore, a positive change in the wage implies a negative change in profit. In algebraic terms, ?P is the variation in prices, ?ci the variation in input cost, ?cs the variation in wage cost, ?T the variation in taxes, and ?B the variation in profits, the financing of the production structure from the sales explained by prices at constant volume will be

Being ?ci = 0 for quality guarantee condition in order not to lose competitive market, ?p = 0 for being the price taker company, ?T = 0 for legal condition it remains then that ?cs = – ?B. The result of the above analysis is called trade off. Firms will seek to maintain the relationship between profit and price8 and, to do so, they will have as a barrier the wage level according to one of the three forms of the Kaleckian relationship9 (Sawyer, 1985). In markets with high inflation, as is the Argentina 2022 Case, the difference between real and nominal magnitudes in contracts matters and some kind of indexation or arbitrage should be applied10. Since public and private accounts register nominal values, the real effects will depend on indicators which are mostly imperfect (Jimenez, 1933). Then, the trade off will be indexations conditioned and, due to the effect of imperfect information, the strategies in the agreements may favor one party or the other (Harsanyi, 1955) (Marshall, 2016). It may happen that the traditional informational opacity in corporate profits versus the instrumental clarity of wages for parity or bargaining may induce occasion behaviors to signal such negotiations (Selten, 1975), composing sub-games that eventually lead to learning paths as a brake on possible abuses of one party over another. This paper focuses on this problem and analyzes the Argentine case based on the restoration of statistics from the National Institute of Statistics and Census, seeking to find theoretical and, then, empirical evidence.

Being ?ci = 0 for quality guarantee condition in order not to lose competitive market, ?p = 0 for being the price taker company, ?T = 0 for legal condition it remains then that ?cs = – ?B. The result of the above analysis is called trade off. Firms will seek to maintain the relationship between profit and price8 and, to do so, they will have as a barrier the wage level according to one of the three forms of the Kaleckian relationship9 (Sawyer, 1985). In markets with high inflation, as is the Argentina 2022 Case, the difference between real and nominal magnitudes in contracts matters and some kind of indexation or arbitrage should be applied10. Since public and private accounts register nominal values, the real effects will depend on indicators which are mostly imperfect (Jimenez, 1933). Then, the trade off will be indexations conditioned and, due to the effect of imperfect information, the strategies in the agreements may favor one party or the other (Harsanyi, 1955) (Marshall, 2016). It may happen that the traditional informational opacity in corporate profits versus the instrumental clarity of wages for parity or bargaining may induce occasion behaviors to signal such negotiations (Selten, 1975), composing sub-games that eventually lead to learning paths as a brake on possible abuses of one party over another. This paper focuses on this problem and analyzes the Argentine case based on the restoration of statistics from the National Institute of Statistics and Census, seeking to find theoretical and, then, empirical evidence.

Academic Background

The problem of wages versus inflation recognizes studies from different points of view and applied to different countries with an inflationary trend. Although this paper presents a general and microeconomic model, it is an additional objective to describe a concrete effect on the Argentine economy. In order to interpret the logic of this country, Ferrer (2003) elaborates a descriptive and analytical paper that allows us to intuit and/or rationalize power schemes. Carlos Rodríguez in Rodríguez (1984), Raúl Frenkel in Frenkel (1986), Daniel Heymann in Heyman (1989) present economic analyses that reflect traditions and policies applied in Argentina prior to the hyperinflation of 1989. Antonelli (2005) describes in more detail the Argentinean case including the incidence of union bargaining and negotiations. A recent study by the Central Bank of Argentina (BCRA, 2021) states that inflation reacts significantly on the basis of nominal variations of money, being the distributive struggle a possible explanation. Graña Colella (2020) recognizes the relevance of distributive bidding as an inflationary factor in Argentina based on statistics on the error correction model. Price Waterhouse Coopers in PWC (2022) describes a significant detail of the Argentine economy that complements with statistics to date. Since labor and institutional vulnerability are complementary and/or inflation-inducing sources, the shadow economy (World Economics, 2022) and its sources (TELAM, 2022) are significant to this work. Regarding the causes of nonparticularized inflation in Argentina, the literature is varied and very extensive. Akerloff et al (1996) detail the endogenous macroeconomic mechanics in non-galloping inflations. Regarding endogeneities, Keifman (2019) describes an interpretation from structural theory. Complementarily, González Andrade (2006) explains the inflationary phenomenon from multiple perspectives.

In relation to the general problem of using a particular model to analyze contexts and relationships, Barro’s work should be considered (Barro et al., 1983). Whether wages and productivity can lead to inflation is not an issue that finds convergent conclusions. Structural foundations and projective models facilitate the understanding of linkage spaces (Goodhart and Pradhan, 2020). Mendieta and Barbery (2017) take for their analysis the well-known Phillips curve in order to understand whether, in fact, unemployment, and its proxy from the wage condition, can also hold as an empirical relationship. Analysis in specific contexts from official data allow understanding the relationship between inflation and wages with local nuances, observing that there are areas of labor relations in which productivity and inflation maintain an inverse relationship (Iheanacho, 2017). At this point, it is worth asking about the wagegrowth relationship, since growth should reduce inflationary trends, and the work of Tosoni (2014) is a valid resource for its interpretation based on the wage share. Marshall (2016) focuses on wage bargaining instruments to analyze the effects on productivity; this type of relationship is something not minor to interpret an eventual relationship between wages and profits.

This paper deals with the proposed relationship in Argentina. Given the computer blackout of the Argentine INDEC the statistics may present micronumerosity (Golderberg, 1991) with collinearity conflicts that may weaken the informative capacity intended (Salmeron and Blanco, 2016).

Material and Methods

Mathematical Model

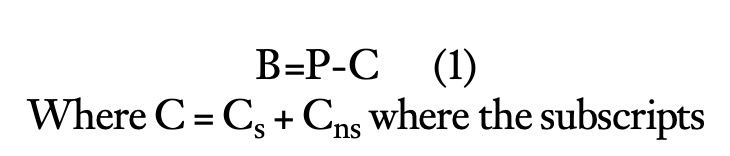

Let B be the industrial profit measured in domestic currency, P11 the revenue for a generic quantity sold q, C the cost of production for that level q, is the proportion of the cost that corresponds to wages, IPC the consumer price index, IVS the index of wage variation and IM the wholesale index, the profit model in a competitive framework before indexation will be given by

where the subscripts s and ns refer to the wage component and the non-wage component will be true that

where the subscripts s and ns refer to the wage component and the non-wage component will be true that

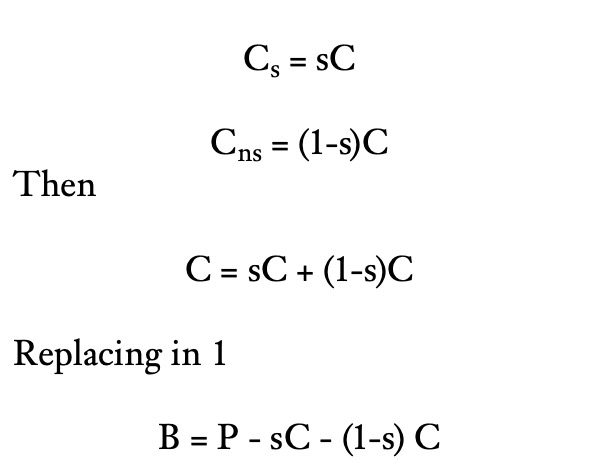

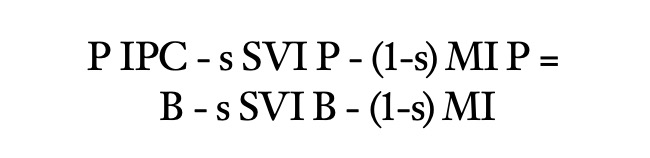

Indexing the expression of benefits in order to maintain over time the strategic relationship indicated in (1) and considering that income is indexed to consumer prices, wages are indexed to the wage variation and costs are indexed to the wholesale index, we obtain the expression of benefits as follows

Indexing the expression of benefits in order to maintain over time the strategic relationship indicated in (1) and considering that income is indexed to consumer prices, wages are indexed to the wage variation and costs are indexed to the wholesale index, we obtain the expression of benefits as follows

![]() Replacing C by its strategic expression in (2) we obtain

Replacing C by its strategic expression in (2) we obtain

![]() With simple algebraic passes we obtain

With simple algebraic passes we obtain

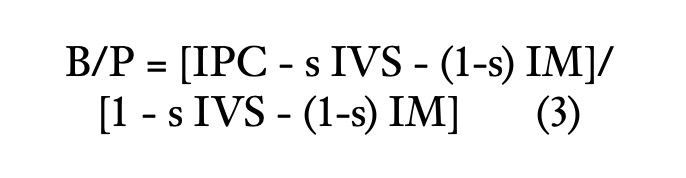

This leads to a first technical conclusion, which indicates that the B/P mark up reflects the following explanatory scheme

This leads to a first technical conclusion, which indicates that the B/P mark up reflects the following explanatory scheme

Results

Results

The term B/P12 refers to the wellknown mark up or brand index, which reflects the added value or benefit of a generic and representative company of an economic society in relation to its price. This indicator is widely used for the purposes of competitive analysis, benchmarking and the feasibility of maintaining the strategic relationship described in (1).

From this expression it can be seen that

• Retail inflation rebuilds margin

• The denominator is always lower than the numerator. Therefore, inflation expressed in unbiased indexes favors mark up.

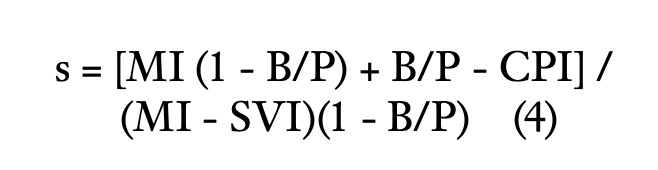

The aggregate B/P ratio could be approximated from the ratio of aggregate profit by taking the level of income tax levied and GDP. With the above and going back to (3), clearing s we get to the following expression

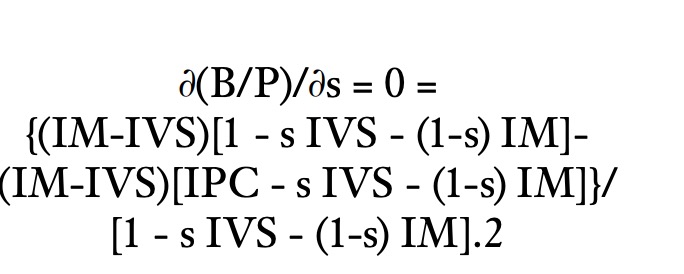

This conclusion explains the equilibrium wage expenditure level in a company that intends to maintain the strategic margin of (1) in the face of the inflationary effects of the context. The theoretical conclusions of this analysis imply that the company will be able to maintain its strategic relationship by paying a given level of wages as long as the wage variation does not exceed wholesale inflation, or the company abuses its dominant position by increasing the B/P ratio. Deepening the analysis, rational decisions should lead every businessman to think that it would be convenient to negotiate a wage level ”s”, so that the B/P ratio is maximized. For this purpose, and starting from expression (3), we proceed to find the critical point according to ?(B/P)/?s=0. Proceeding with the derivation technique

This conclusion explains the equilibrium wage expenditure level in a company that intends to maintain the strategic margin of (1) in the face of the inflationary effects of the context. The theoretical conclusions of this analysis imply that the company will be able to maintain its strategic relationship by paying a given level of wages as long as the wage variation does not exceed wholesale inflation, or the company abuses its dominant position by increasing the B/P ratio. Deepening the analysis, rational decisions should lead every businessman to think that it would be convenient to negotiate a wage level ”s”, so that the B/P ratio is maximized. For this purpose, and starting from expression (3), we proceed to find the critical point according to ?(B/P)/?s=0. Proceeding with the derivation technique

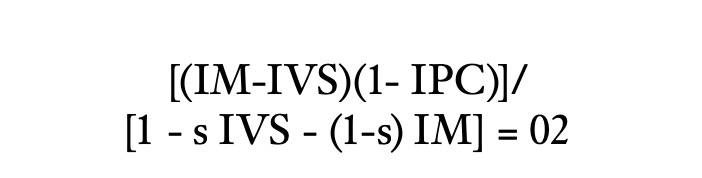

Intervening algebraically, it finally follows that

Intervening algebraically, it finally follows that

The denominator indicates that (IM-IVS)(1- IPC) = 0 expression that is independent of ”s”. However, we must not lose sight of the fact that this optimization is applied to economics, so it must be true that [1 – s IVS – (1-s) IM]2 must be different from 0. Working the expression arithmetically it turns out that s><(IM-1)/(IM-IVS), but it can never happen that s = (IM-1)/(IM-IVS). Since from the denominator the only way that equality is possible is that IM = IVS, then it can only be true that s<(IM-1)/(IM-IVS) result that does not allow to quantify some value of ”s” but that taken this expression to management spaces indicates that:

The denominator indicates that (IM-IVS)(1- IPC) = 0 expression that is independent of ”s”. However, we must not lose sight of the fact that this optimization is applied to economics, so it must be true that [1 – s IVS – (1-s) IM]2 must be different from 0. Working the expression arithmetically it turns out that s><(IM-1)/(IM-IVS), but it can never happen that s = (IM-1)/(IM-IVS). Since from the denominator the only way that equality is possible is that IM = IVS, then it can only be true that s<(IM-1)/(IM-IVS) result that does not allow to quantify some value of ”s” but that taken this expression to management spaces indicates that:

• Since it is not possible that IM = IVS, it must be the case that IM>IVS so that s>0.

• The signal that dominates wage bargaining is based on the IM, not on the IPC, and it is a management trait that the share of wages in business costs will have a higher level explained by the IM.

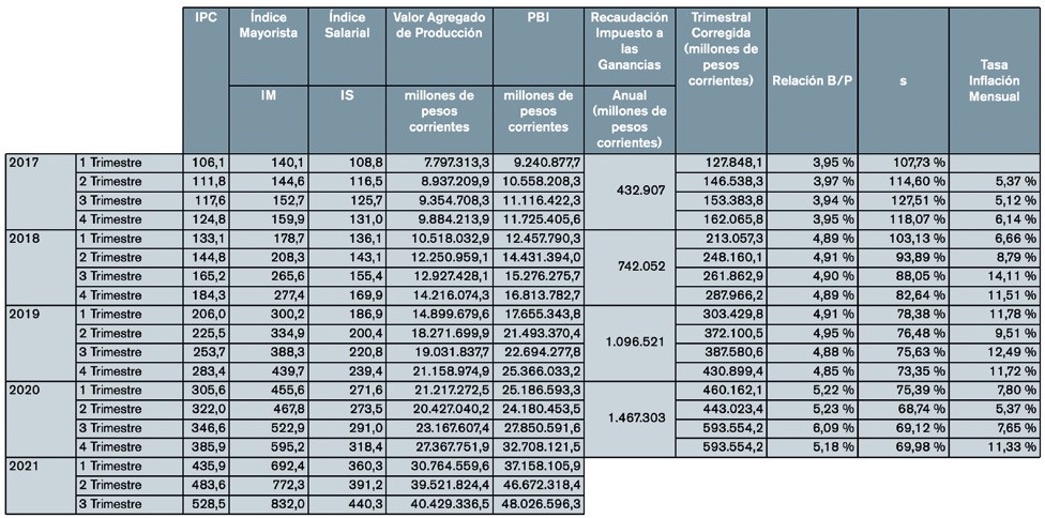

Fuente: INDEC, Portal Argentina y Elaboración Propia

Impuesto a las ganancias trimestral resulta del valor anual afectado de un coeficiente que refleja la incidencia del Valor Agregado de Producción trimestral en su total anual

Relación B/P resulta del cociente entre el Impuesto a las Ganancias Trimestral dividido 35% y el PBI

The Argentine Case 2016-2022

Based on the information provided by the Argentine INDEC (INDEC, 2022), the income taxation of Argentine companies (Portal Argentina, 2022), and the conclusions reached in the model described above, we find the results in Table 1.

Since the information describing income tax collection is reported on an annual basis, for the purpose of opening it in quarterly values, it is proportionalized according to the ratio obtained from the value added of production15. Profits or benefits, after being expressed in quarters, are obtained by generalizing a 35% rate and correcting for informality (TELAM, 2022) and (World Economics, 2022).

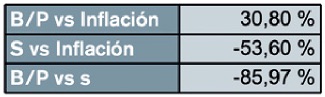

The aliquots ”s” resulting from the calculation initially offer values above 100%, which is explained by the absence of empirical correction factors to calibrate the model. This problem does not generate conflicts in interpreting the data, since what is relevant is the series of values and not their punctual magnitude. The results allow us to interpret the following correlations (Table 2):

As can be seen in the B/P versus s the negative correlation allows us to interpret a trade-off effect. In particular, the correlation value allows us to assume that the variations reflect a high explanatory value. The positive correlation between B/P and inflation validates the theoretical conjectures of the model since inflation would allow margin recovery. On the other hand, the negative correlation between s and inflation only validates the study since it has been amply demonstrated that inflation reduces the wage level.

Given the clear micronumerosity effect, more sophisticated econometric instruments are not advanced until the amount of data is sufficient.

Conclusions

The traditional tension between wages and business benefits remains valid.

This paper focuses on this conflict by proposing a trade-off relationship between the two variables.

The precedents on the subject are profuse, covering different views, but always in contexts of economic policy and macroeconomics. This paper proposes to analyze these cases from theoretical and empirical approaches based on high Argentinean inflation. The fact that inflation is high places Argentina at the center of the analysis since, in those years, hyperinflation is not diagnosed. It should be noted that in hyperinflationary contexts (Cagan, 1956) (Reinhart and Savastano, 2003) the lack of information provided by prices generates a break in the chain of payments with a severe drop-in activity and, consequently, analyses comparing temporary figures lose consistency.

The microeconomic complexity that results in a clear asymmetry of information when companies are not co-managed can unbalance the relationship between corporate profits and social charges, this being the main motivating factor of the work.

Theoretical analyses reflected in microeconomic models where variables are indexed on the basis of aggregate price indicators show advantages for the increase of benefits through wage transfers with significant explanatory presence of inflation.

Putting the above conjecture to be validated or not by the data in Argentina, we find a clear trade off between benefits and wages. The correlation analysis accompanies the other needs of the relationship between profits and wages in the face of inflation, obtaining the expected results: inflation depresses wages and boosts profits.

The results should be considered provisional given the micronumerosity of the available information base.

With the above, the proposal allows us to continue this work towards more ambitious horizons based on the availability of a larger amount of data for more efficient econometric analysis.

1. A zero-sum game is one in which the players obtain win-lose outcomes with equal absolute value. In other words, what one wins is what the other loses (Gibbons, 2022). In competitive games, the firm being a price taker reflects this phenomenon.

2. Trade Off refers to the inverse correlative effect between two significant variables. When one expands, the other contracts, giving a sort of offsetting effect (hence the name).

3. The ”freely” qualification refers to the absence of failures in the understanding of substitutes to the product to be purchased. At this point, the customer’s level of information is relevant in order to measure the magnitude of the substitution rate and what is its limit for assuming that there is no reasonable substitute. The lower the substitution rate, the greater the market power of the supplier.

4. This argument can be disputed to the extent that the company depends on a rentier investor who directs its business towards predatory formats. In that case, the model should include the behavior of the investor under the non-satiation type, which is beyond the scope of this paper.

5. It would be ruinous when a market power enters an abusive zone.

6. Quantity of applicable input in the unit of sales product.

7. It is considered a competitive framework; therefore, companies are price takers. B2B is business to business, i.e., supplier companies.

8. It is called Mark Up.

9. It refers to the theories elaborated by Micha? Kalecki.

10. In Argentina, the convertibility law 23928 is in force, which prohibits indexations, however, in fact it happens to avoid ruinous businesses.

11. Although the letter I is normally used for income and P for prices, given that the expression under study refers to a level of production q, the basis for income variation will come from the hand of P and, therefore, this license is taken.

12. The mark up relates the unit profit to the price of the marketed product. This paper approximates this measure by taking the ratio of aggregate profit to revenue. Differences may be found according to the inventory policy established by a specific company.

13. It is considered a representative behavior for the purpose of relaxing the trembling hand effect (Selten, 1975).

14 This optimizing operation will only have a maximum destination, since strategic actions in the opposite direction would be mathematically taboo in a rational framework (Glover et all, 1996).

For this reason, we will not proceed with the curvature analysis.

15. Assuming established companies in the market, the profit should be aggregated in an approximate way to the aggregation of sales. Since Value Added Production is a proxy for GDP, the quarterly disaggregation in this way should be explanatory.

Bibliographic References

Akerlof, G.A. (1970). The market of lemons. Quality Uncertainty and the Market Mechanism. The Quarterly Journal of Economics, 84 (3), 488-500.

Akerlof, G. A., Dickens W., and Perry G. (1996). The Macroeconomics of Low Inflation. Brookings Papers on Economic Activity, 1, 1-59.

Alarco Tosoni, G. (2014). Wage participation and economic growth in Latin America, 1950-2011. ECLAC, 113, 43-60.

Antonelli, E. (2005). Inflation and wages. Actualidad Económica, 15(56), 21-24.

Barro R., and David G. (1983). A Positive Theory of Monetary Policy in a Natural Rate Model. Journal of Political Economy. 91 (4), 589-610.

BCRA (2021). On the Determinants of Inflation in Argentina. Available at https://centraldeideas.blog/sobre-los-determinantes-de-lainflacion-en-argentina/. Last accessed February 12, 2022.

Cagan, P. (1956). The Monetary Dynamics of Hyperinflation. Studies in the Quantity Theory of Money, ed. by Friedman, M., 25-117.

Goodhart Ch., Pradhan M. (2020). The Great Demographic Reversal. Palgrave Mac Millian.

Díaz Velarde, A., et all (1996). Heuristic Optimization and Neural Networks. Paraninfo.

Erauskin, I. (2020). Labor participation and earnings inequality: some empirical evidence for the period 1990-2015. Applied Economic Analysis, 28 (84), 173-195.

Ferrer, A. (2003). La Economía Argentina. FCE.

Frenkel, R. (1986). Wages and inflation in Latin America. Results of recent research in Argentina, Brazil, Colombia, Costa Rica and Chile. Economic Development, 25(100), 587-622.

Gibbons, R. (2022). A first course in game theory. Antoni Bosch.

Goldberger, A. (1991). A course in Econometrics. Harvard University Press.

Gutiérrez Andrade, O. and Zurita Moreno, A. (2006). On inflation. Perspectivas. 9(3), 81-115.

Harsanyi, J. C. (1995). Games with Incomplete Information. The American Economic Review. 85(3), 291-303.

Heyman, D. (1986). Three essays on inflation and stabilization policies, ECLAC. Working Paper K° 18.

Heymann, D., and Canavese, A. (1989). Public Tariffs and Fiscal Deficits: Trade-offs between Short-run and Long-run Inflation. Revista de Economía, Banco Central del Uruguay. 3 (3), 1-18.

Iheanacho, E. (2017). Empirical Review on the Relationship between Real Wages, Inflation and Labour Productivity in Nigeria. ARDL bounds testing approach. International Economics and Business. 3 (1), 9-19.

INDEC (2022). Consumer Price Index (Retail). Available at https:// www.indec.gob.ar/indec/web/Nivel4-Tema-3-5-31 . Last accessed February 20, 2022.

INDEC (2022). Wholesale Price Index. Available at https://www.indec. gob.ar/indec/web/Nivel4-Tema-3-5-32. Last accessed February 20, 2022.

INDEC (2022). Wage Variation Index Available at https://www. indec.gob.ar/indec/web/Nivel4-Tema-4-31-61. Last accessed February 20, 2022.

INDEC (2022). Value Added Production. Available at https://www. indec.gob.ar/indec/web/Nivel4-Tema-3-9-47. Last accessed February 20, 2022.

Antonelli, E. (2002). Inflación de salarios. Economic Research Institute. Available at https://aaep.org.ar/anales/works05/ antonelli.pdf (2002). Last accessed February 20, 2022.

Jiménez, L.F. (editor) (1993). Indexation of Financial Assets. CEPAL, Estudios Políticos y Sociales.

Keifman, Saul (2019). Meaning, Scope and Limitations of Structural Inflation Theory LIV Annual Meeting| 2019. Available at https://aaep.org.ar/anales/works/works2019/keifman.pdf. Last accessed February 12, 2022.

Kydland, F., and Prescott E. (1977). Rules Rather than Discretion: The Inconsistency of Optimal Plans. Journal of Political Economy June. 85 (3), 473-492.

Graña Colella, S. (2020). The causes of Argentine inflation: an estimation employing the VECM methodology for the period 2003-2019. Faces. 2020, 26 (55), 73-86.

Marshall, A. (2016). The wage-productivity relationship: wage incentives in industrial collective bargaining agreements. Work and Society. N. 26, 5-18.

Mas Colell A. et all (1995). Microeconomic Theory. Oxford University Press.

Mendieta, P. and Barbery, C. H. (2017). Understanding the Phillips Curve of the 21st century: state of the art. Latin American Journal of Economic Development 28, 135-164. Available at: <http:// www.scielo.org.bo/scielo.php?script=sci_arttext&pid=S2074- 47062017000200006&lng=es&nrm=iso>. Last accessed February 12, 2022.

Motta, M. (2004). Competition Policy: Theory and Practice. Cambridge University Press.

Palazuelos, E., and Fernández, R. (2008). Economic Growth and Trade Off between Productivity and Employment in European Economies. International Development Economic Studie., 8 (1), 42-82.

ARGENTINA PORTAL (2022). Income Tax Collection. Available at https://www.argentina.gob.ar/economia/ingresospublicos/ recaudaciontributaria. Last accessed February 20, 2022.

PWC (2022). Relación Salarios vs inflación en Argentina 2018. Available at https://www.pwc.com.ar/es/publicaciones/ economic-gps/salarios-vs-inflacion.html. Last accessed 20 February, 2022.

Reinhart, C. M., and Savastano, M. A. (2003). Realities of modern hyperinflations. Finance & Development June, 20-23.

Rodriguez, C. (1984). Inflación, salario real y tipo de cambio real. CEMA, papers. Available at https://ucema.edu.ar/ publicaciones/download/documentos/41.pdf. Last accessed February 12, 2022.

Romero Huamani, R.M. (2014). Theory of freedom of choice: application in ethical praxis. Quipukamayoc Revista de la Facultad de Ciencias Contables UNMSM. 22 (42), 169-177.

Salmerón R. (2016). The Problem of Small Sample Size in Linear Regression: Micronumericality. ASEPUMA Electronic Journal of Communications and Papers. 17, 167-177.

Sawyer, M. C. (1985). The Economics of Michal Kalecki, Hampshire. Macmillan.

Selten, R. (1975). A reexamination of the perfectness concept for equilibrium points in extensive games. International Journal of Game Theory. 4, 25-55.

Streb, J. M. (1998). The meaning of rationality in economics. UCEMA.

TELAM (2022). Evasion and Avoidance Loss. Available at https:// www.telam.com.ar/notas/202104/551753-lo-que-se-dejade-pagar-en-impuestos-en-argentina.html . Last accessed February 12, 2022.

World Economics (2022). Shadow Economy Argentina. Available at http://dev.worldeconomics.com/Informal-Economy/ Argentina.aspx. Last accessed February 12, 2022.